Understanding nuances of early action and early decision, exploring merit-based aid, and utilizing 529 plans and loans effectively can impact you and your stressed college-bound teen's journey.

Read MoreWhile cash or gift cards are always appreciated, consider something with lasting value that can help launch college and high school graduates towards financial independence.

Read MoreStarting the New Year with the same old resolutions? Let’s recognize questionable resolutions, including three destined for failure, plus what should be considered for successful planning outcomes.

Read MoreCongress has created the “FAFSA Simplification Act”, which makes the upcoming 2024-2025 college admissions process a complicated mess.

Read MoreResolutions to improve your financial situation similar to one’s made last year? Here’s how and why to consider actions and timeframes, instead of focusing on desired outcomes.

Take control, don’t be another victim to make your teen happy… spending won’t make them happy.

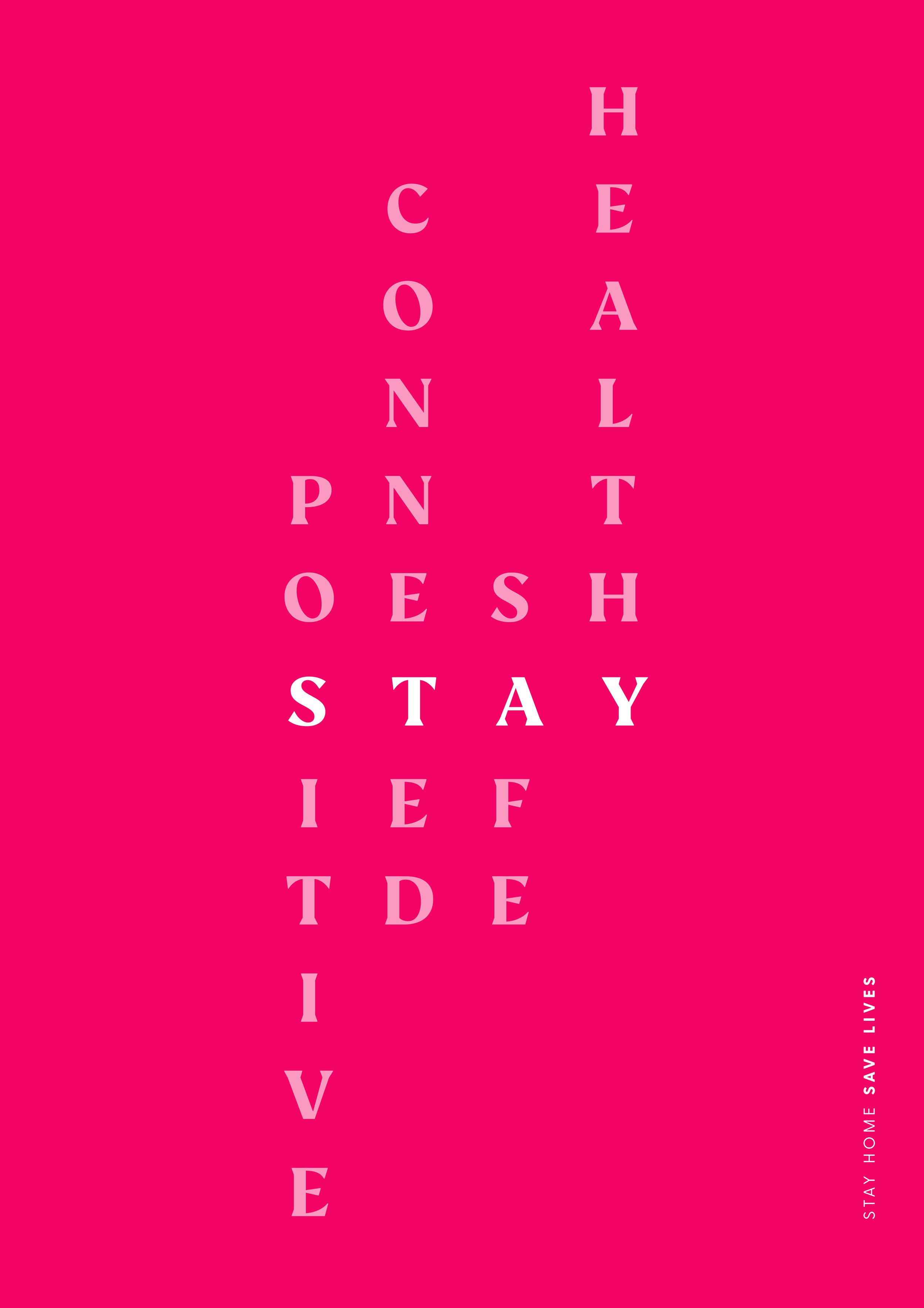

Read MoreTurn down the hyperbole, 2020 offered great opportunities to refinance, save, invest, WFH, and focus on your why.

Read MoreCollege Planning is more than 529s and student loans, focus on how to take less of each.

Read MoreInstead of talk of the future, act on the constants - change and time.

Read MorePutting off your health or planning over fear isn’t the “new normal”.

Read MoreCARES Act legislation impacting 2020 tax laws, provisions and deadlines.

Read MoreBig picture opportunities for 3 RE’s: Refinance, Rebalance and Reset.

Read MoreA plan is not a buy-and-hold investment, it needs to be dynamic as you evolve.

Read More