While the cause of volatility changes, a constant remains - portfolios don't care about your feelings.

Read MoreMarch signals the beginning of homebuying season, but before scrolling Zillow, open houses, and finding a real estate agent, let’s discuss things you need to implement.

Read MoreIf one waits for 5% mortgages, there are considerable opportunity costs. Potential homebuyers should prepare to act by utilizing these tools and best practices.

Read MoreWith markets All Down The Line, thinking it will make you Happy to become Exile on Wall St?

Read MoreAction items based upon the old adage “Inflation rewards debtors and hurts creditors”.

Read MoreLosing investments can offset realized profits as well as up to $3,000 in non-investment income each year.

Read MoreMay be good reasons to change jobs or quit, best to remove emotions and seek validation before resignation.

Read MoreSince 1976 the bond market has been negative just 3 times, 2021 could be the fourth and worst.

Read MoreRevisiting the conundrum for income investors in today’s low-interest rate environment.

Read MoreTurn down the hyperbole, 2020 offered great opportunities to refinance, save, invest, WFH, and focus on your why.

Read MoreInstead of talk of the future, act on the constants - change and time.

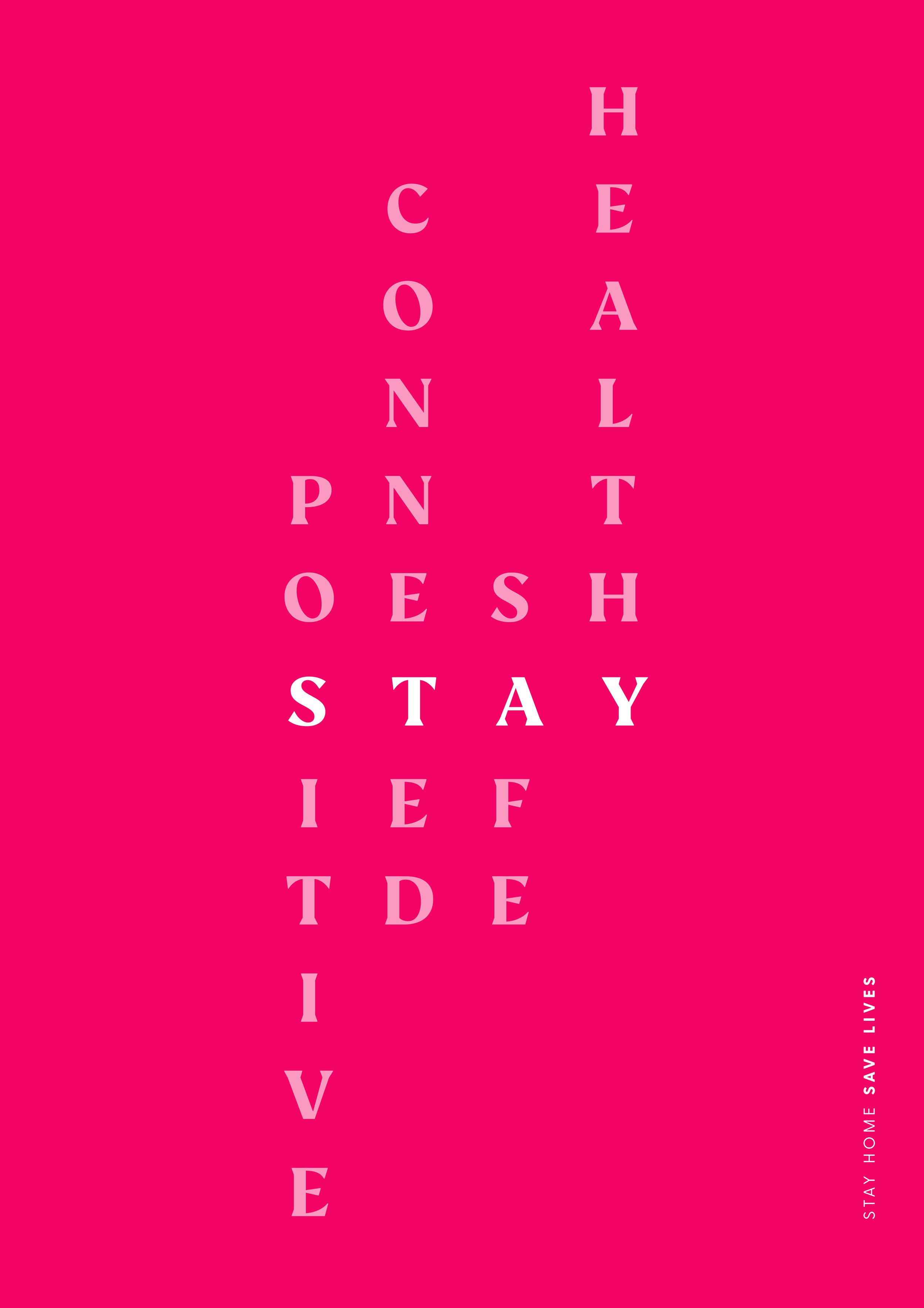

Read MorePutting off your health or planning over fear isn’t the “new normal”.

Read MoreCARES Act legislation impacting 2020 tax laws, provisions and deadlines.

Read MoreBig picture opportunities for 3 RE’s: Refinance, Rebalance and Reset.

Read MoreCan a low dividend yield be more favorable over the long-term?

Read MoreFun ways to embrace budgeting, power of saving & philanthropy.

Read MoreYes interest rates are rising. Instead of forecasters, focus on how to evaluate the impact to you, your family, business and portfolios in order to seek opportunities and mitigate risks.

Read More